Y’s Tips Channel

このチャンネルは、日本に住む外国人のために日本の暮らしに必要な情報を英語で提供します。

#11 How is the insurance fee calculated? (社会保険料の計算方法について)

Today I’d like to talk about how the insurance fee is calculated. Do you know how much do you pay? I hope I can give you the answer today.

今回は社会保険料の計算方法をお伝えします。みなさんは自分の保険料がいくらか知っていますか?今日はその答えをお伝えできればうれしいです。

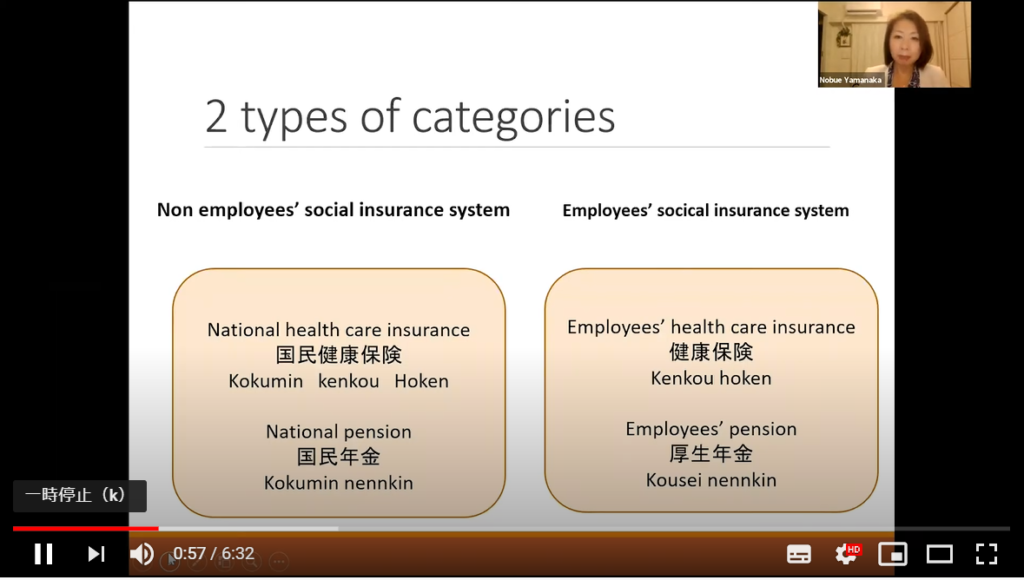

First of all let me divide the people into the two categories. One is non-employee social insurance system, another one is employee social insurance system.

The people who work for themselves like a shop owner or freelancers or farmers those people are enrolled in non-employee social insurance system, national health care insurance and national pension system. Those people pay the premiums by themselves. On the other hand the people who work for the company or the government, they are enrolled in employees social insurance system, employees’ healthcare insurance and employees’ pension system. Their premiums are deducted from their salary every month and the company pay to the government instead.

最初に2つの社会保険制度に分けます。自営業、フリーランサー、農業従事者のような方は、国民健康保険と国民年金に加入しています。この方たちは、保険料を自身で支払っています。会社員、公務員は被用者保険すなわち健康保険、厚生年金に加入しています。この方たちの保険料は、毎月給与天引きされ会社が代わって国に納めます。

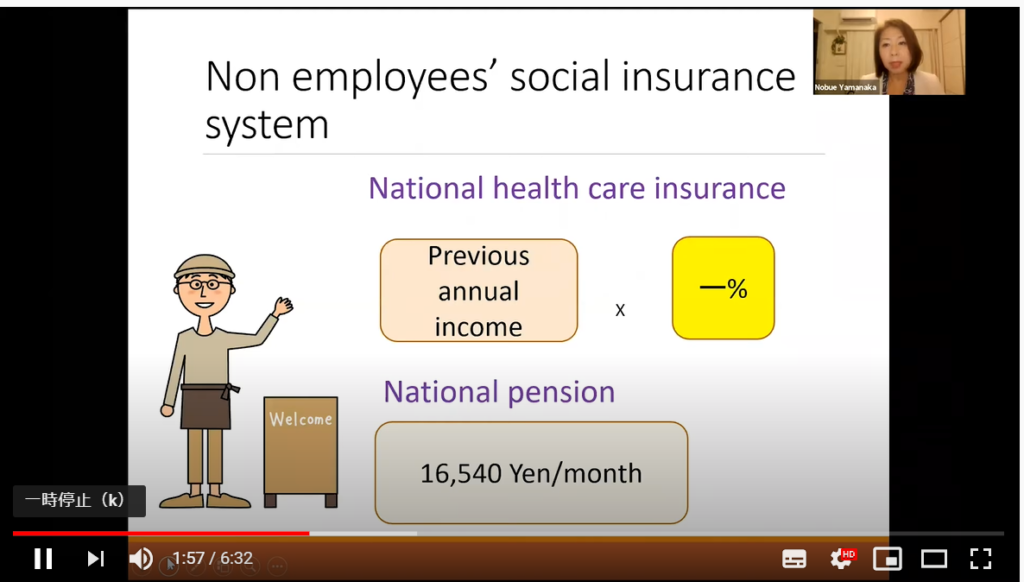

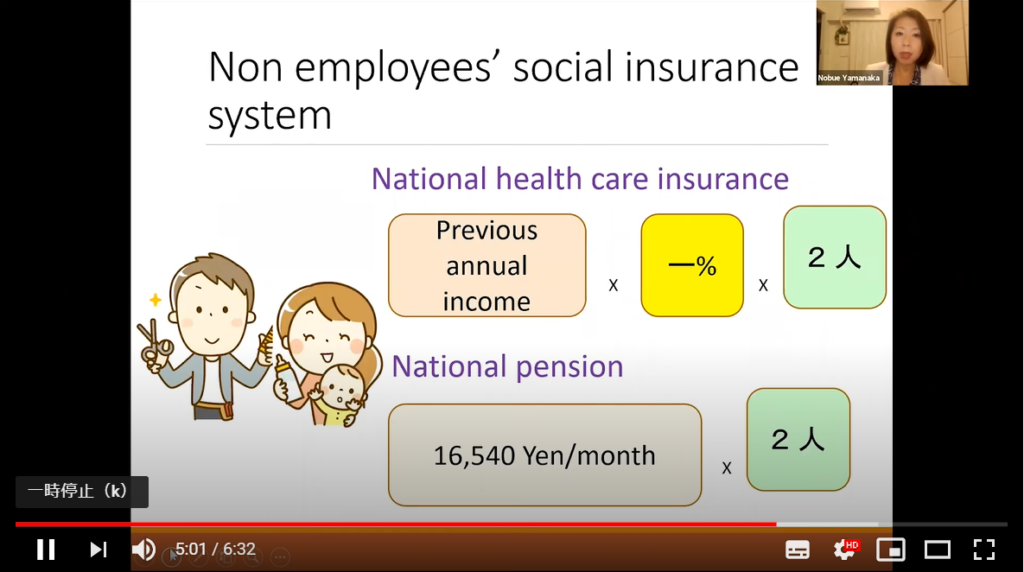

Let me explain more detail about the non-employee social insurance system. For example he is a shop owner and he is enrolled in national healthcare insurance. His premiums is calculated like this previous annual income times percentage. This percentage is different depending on where he lives. Also he is enrolled in national pension, national pension premiums is 16,540 yen per month. This amount applies for all the people who are enrolled in national pension system.

では、もう少し詳しくみていきましょう。例えばこの彼はお店のオーナーで、国民健康保険に加入しています。彼の保険料は、前年の収入にある%を掛けて求められます。この%は、居住地によって異なります。国民年金保険料は月16,540円です。この金額はすべての人が同額です。

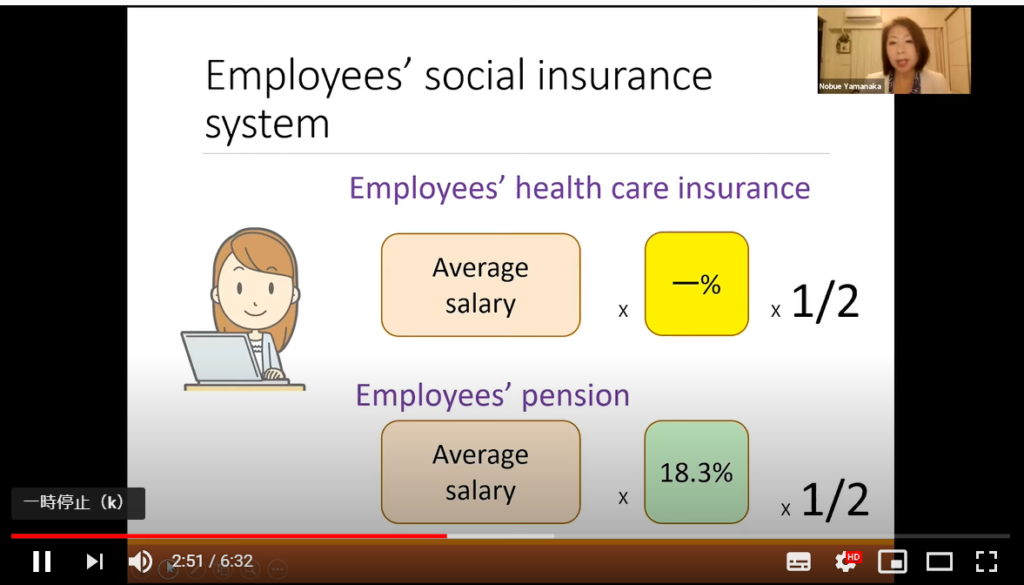

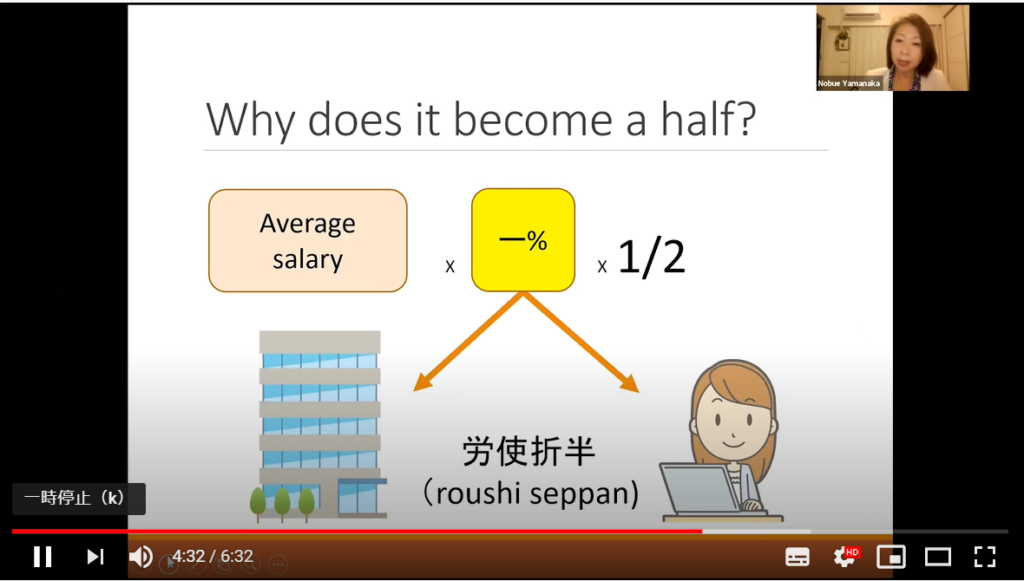

Let’s move on the employees’ social insurance system. She’s enrolled in employees’ healthcare insurance and her insurance premiums is calculated like this. Average salary times percentage times one over two. And employees’ pension premiums is calculated like this, average salary times eighteen point three percent times one over two. Eighteen point three percent applies for the people who are enrolled in employees’ pension.

では被用者保険にうつりましょう。彼女は健康保険に加入しています。その保険料は平均給与(標準報酬月額)にある%が掛けられ1/2されます。厚生年金保険料は平均給与に18.3%が掛けられさらに1/2されます。18.3%という料率はすべての厚生年金被保険者に適用されます。

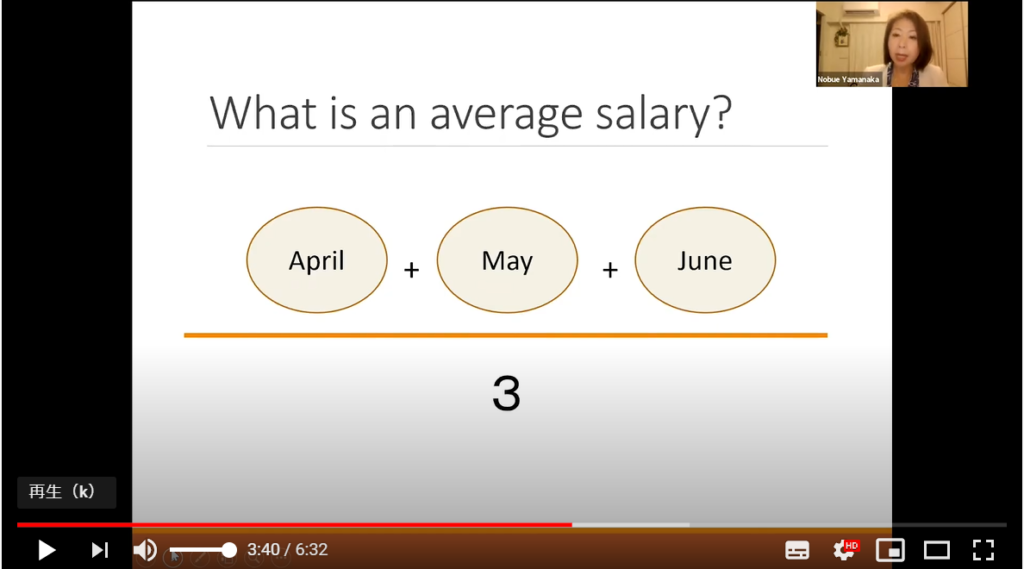

What is an adversary? When it comes to the social insurance system the average salary means for three months salary, April, May and June those three months salary are sums up and divided by three. Then we call it average salary.

平均給与額(標準報酬月額)とは何でしょうか?社会保険料の算出においては、4月、5月、6月の3ヶ月の給与額を合計し3で割り、それを標準報酬月額と呼んでいます。

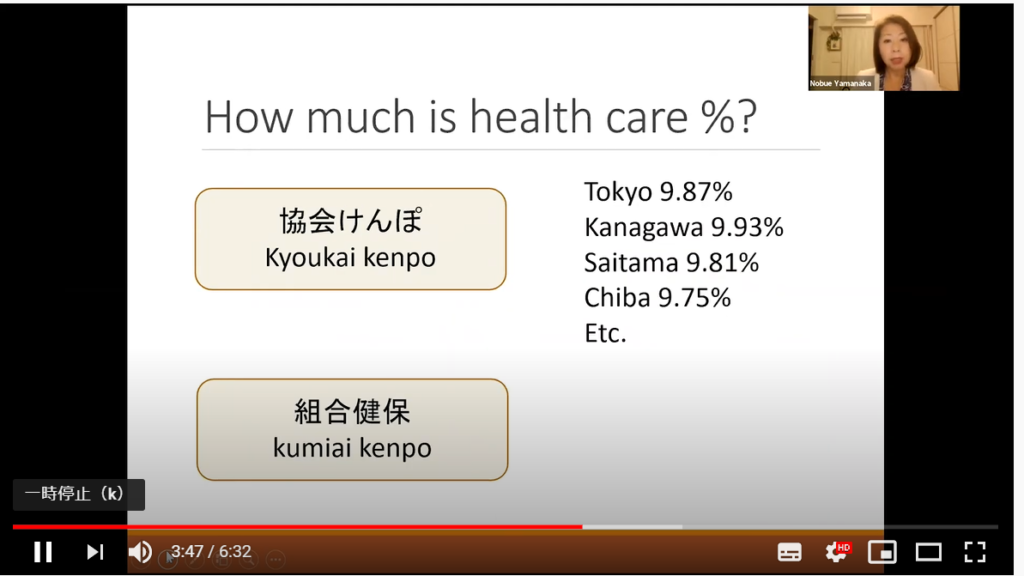

How much is the health care insurance percentage? If your company provides you kyokai kenpo, the percentage is different depending on your company’s address. If your company’s address is in tokyo the percentage is 9.87. If your company’s address is in kanagawa prefecture the rate is 9.93 percentage and so on. If your company provides you a kumiai kenpo, the rate is a different depending on the company.

では、健康保険料の料率はいくらでしょうか?もしあなたの会社が協会けんぽであれば料率は会社の所在地によって異なります。東京であれば9.87%、神奈川であれば9.93%といった具合です。もしあなたの会社が組合けんぽであれば、会社ごとに料率が異なります。

Then why does it become a half? Under the employees’ social insurance system, your company is responsible to pay the half amount of your premiums which is called roushi seppan in Japanese.

では、なぜ保険料が2分の1になるのでしょうか?被用者保険では、雇用主が被用者の保険料の半分を支払う義務を負っているからです。これを労使折半と呼びます。

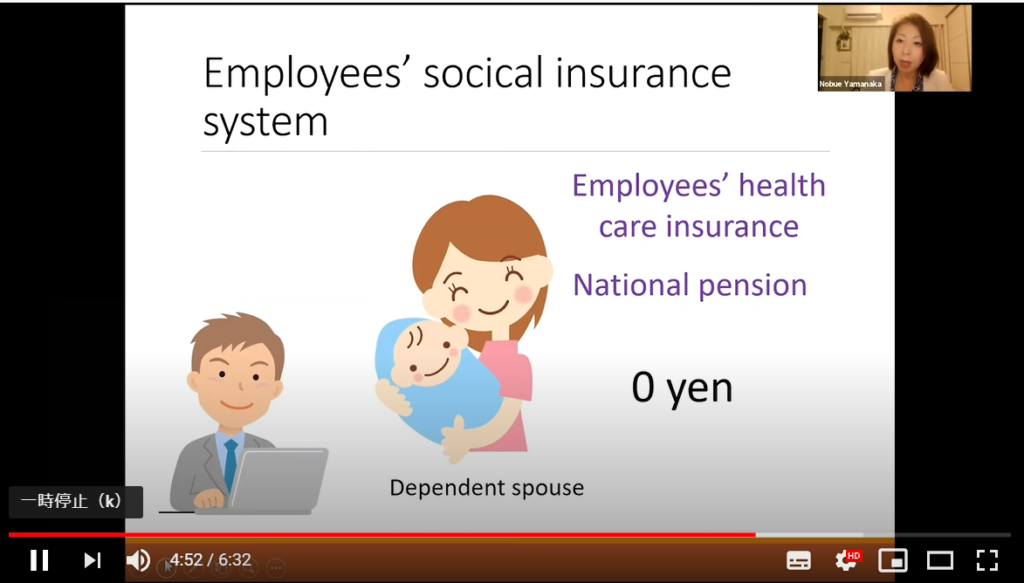

Also under the employees’ social insurance system, if you are a dependent spouse you don’t have to pay any premiums because your premium is exemption.

被用者保険では、扶養の配偶者は保険料の支払いが要りません。免除されています。

However under the non-employee social insurance system there is no exemption system for dependent spouse. So if you are a dependent spouse you have to pay the premiums by yourself. That is the difference between non-employee social insurance and employees’ social insurance system.

一方国民健康保険、国民年金については、扶養の配偶者だからといって保険料が免除にはなりません。自分自身の保険料の支払いが必要です。ここは、被用者保険との違いです。

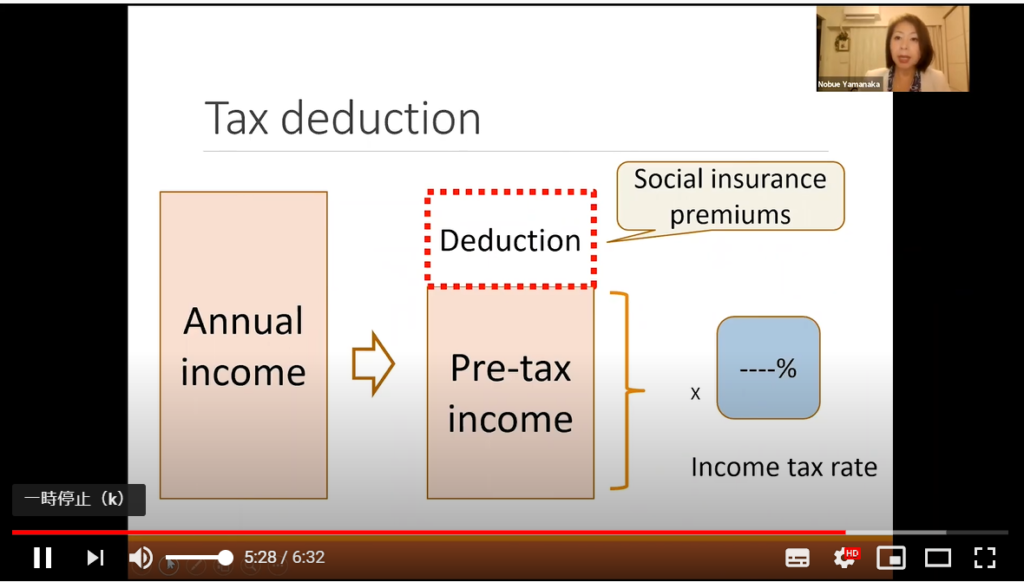

You may think your social insurance premiums is very expensive, but those premiums are tax deductible so you can deduct it from your annual income and you can get some tax benefit. If you work for a company, your company do the tax calculation for you. But if you work for yourself you have to do the tax calculation by yourself. So don’t forget to deduct your premiums from your annual income so that you can get tax benefit.

社会保険料がとても高いと感じるかも知れませんが、この保険料は社会保険料控除として収入から差し引くことができます。会社員であれば、年末調整として会社が税金の計算をしてくれますが、自営業の場合は、ご自身で確定申告をする必要があります。忘れずに社会保険料控除をし、税金のメリットを受けてください。