Y’s Tips Channel

このチャンネルは、日本に住む外国人のために日本の暮らしに必要な情報を英語で提供します。

#19 What is Nenmatsu chousei? 年末調整について

Today I’d like to talk about Nenmatsu Chousei. Nenmatsu Chousei is a special tax calculation system in japan.

今回は年末調整についてお話します。年末調整とは、日本における特別な税金計算の仕組みです。

Nenmatsu Chousei is used for only the people who work for the company or the government . If you work for yourself you do the final return instead which is called Kakutei Shinkoku in Japanese.

年末調整とは、会社員あるいは公務員の方のための制度です。自営業の方などは、確定申告をします。

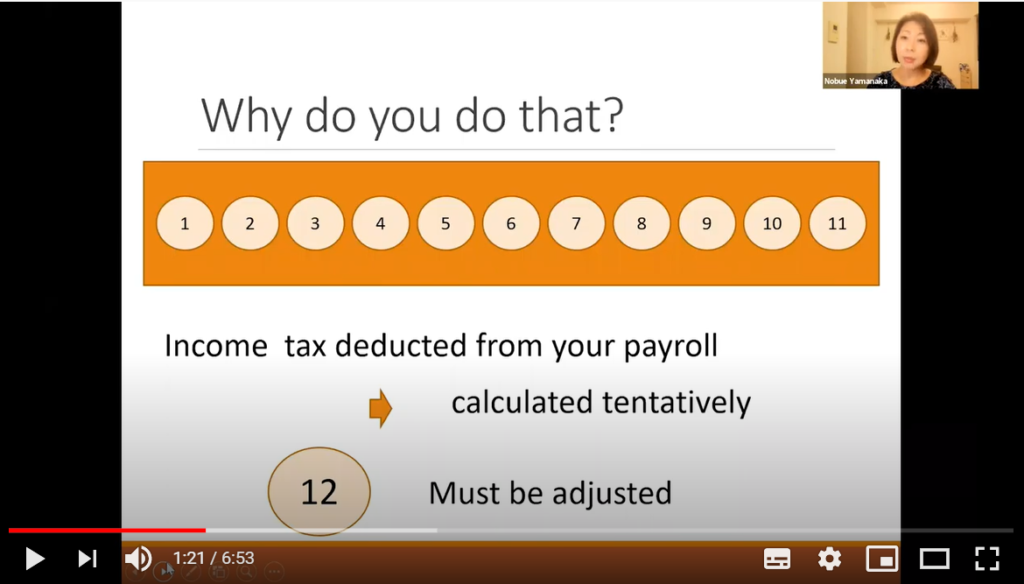

Why do you do the Nenmatsu Chousei? Because income tax cannot be calculated unless your annual income is fixed. If you want to pay your income tax in December all at once you may have little money are left in December since your income tax can be a big amount of money. That kind of situation makes some people unhappy so the company assumes how much your annual income will be then your income tax is calculated tentatively. Your partial income tax are deducted from your every month’s payroll from January to November. In December your tax is adjusted. This is how Nenmatsu Chousei works.

年末調整はなんのためにするのでしょうか?所得税は、年収が定まらないと計算ができません。もし所得税全額を12月に一気に支払おうとすると、12月の手取り収入がとても少なくなってしまう可能性があります。なぜならば所得税は大きな金額になってしまうこともあるからです。こういう状況をあまり好まない人もいます。そのため会社がその人の年収を見積もり、所得税を仮計算し毎月の給与(1月から11月)から少しずつ差し引き12月で調整をします。これが年末調整です。

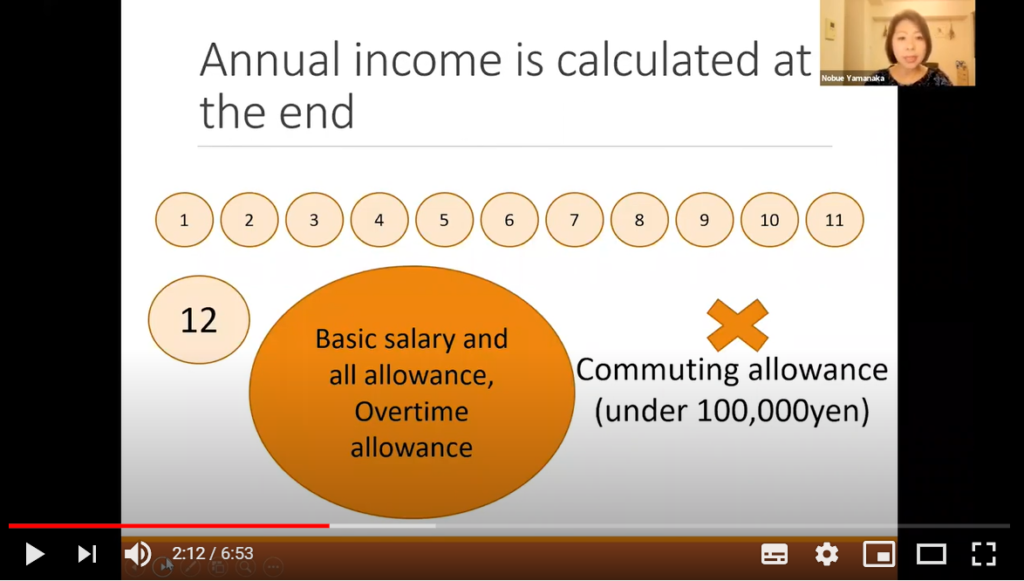

Annual income includes basic salary and all allowance. If you have over time allowance which is included as well. However commuting allowance is not included as annual income, if the amount is under 100,000 yen per month. Because which is considered as an expense.

年収には基本給とすべての手当が含まれます。もし残業手当がある場合はそれも含まれます。ただし月10万円以下の通勤手当は経費と認められているため年収には含まれません。

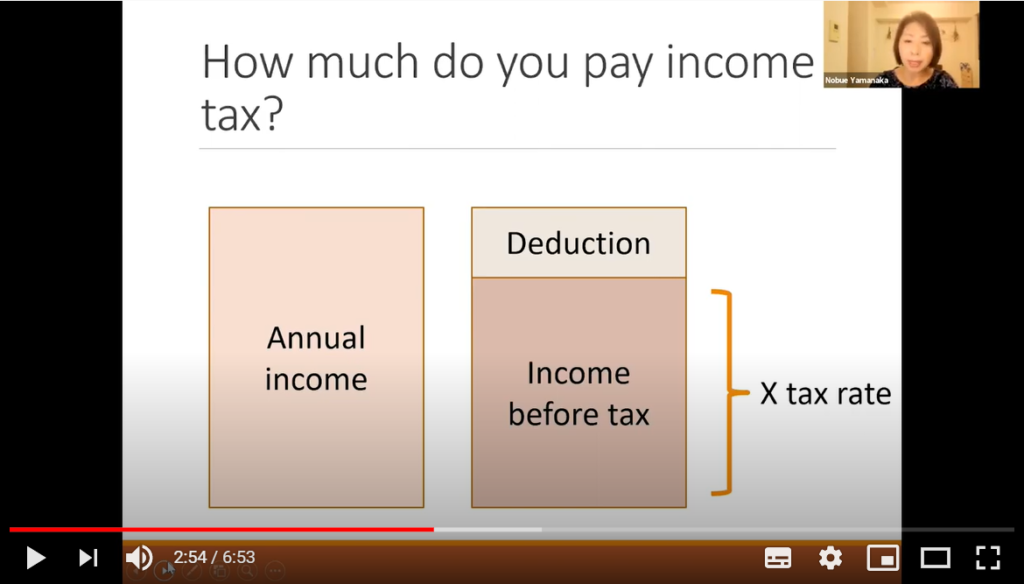

Here is a procedure how to calculate your income tax. Here is your annual income, you can deduct some amount of money as an expense and the laid money are called income before tax and tax rate is apply on that.

所得税は以下のようなプロセスで計算されます。年収から、経費として一定の金額が差し掛かれ、残ったお金が「課税所得」です。そこに税率が掛けられます。

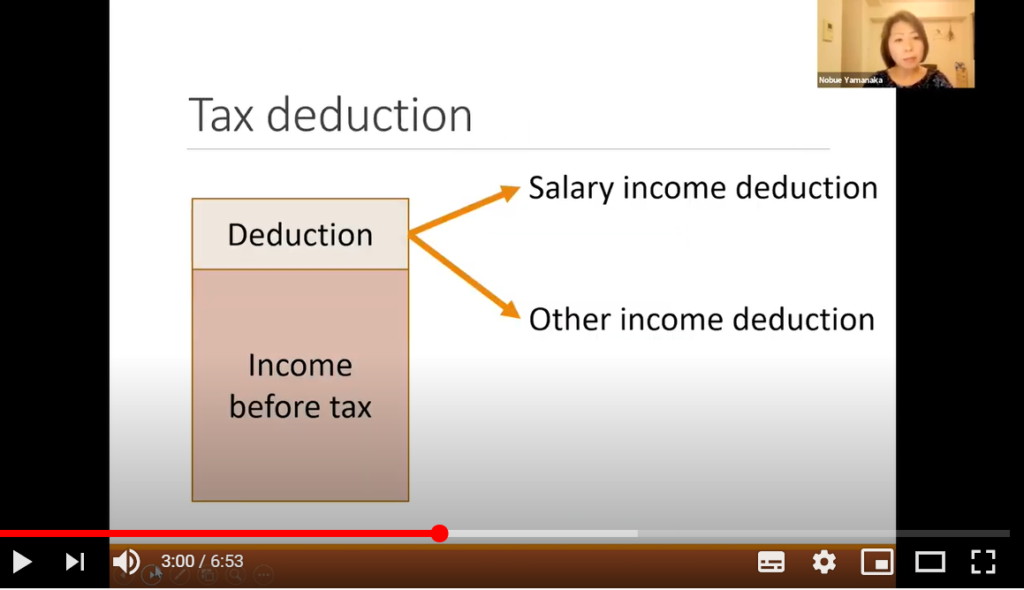

There are two types of tax deduction. Salary income deduction and other income deduction.

控除には、給与所得控除とその他の所得控除の2種類があります。

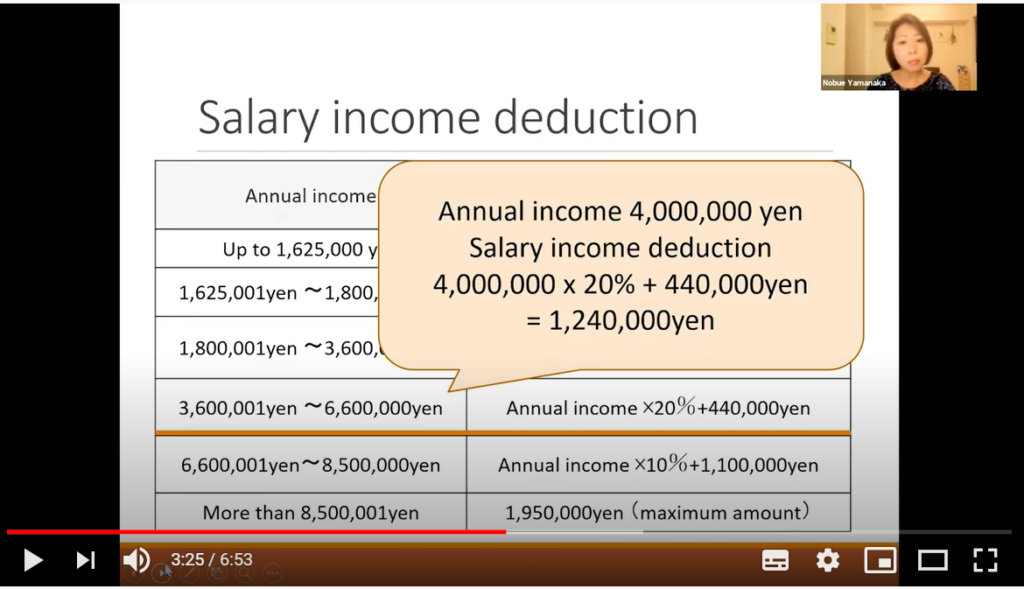

Salary income deduction are calculated differently according to your annual income. If your annual income is 4 million yen, your salary income deduction is calculated like this. 4 million yen times 20 percent plus 440,000 yen equal to one billion two hundred forty thousand yen. You can deduct this amount of money from your annual income without any receipt.

給与所得控除は、年収により計算式が異なります。もしあなたの年収が400万円であれば、以下の通りの計算です。 4,000,000円x20%+440,000円=124万円。この金額はみなし経費なので、領収書不要で年収から差し引けます。

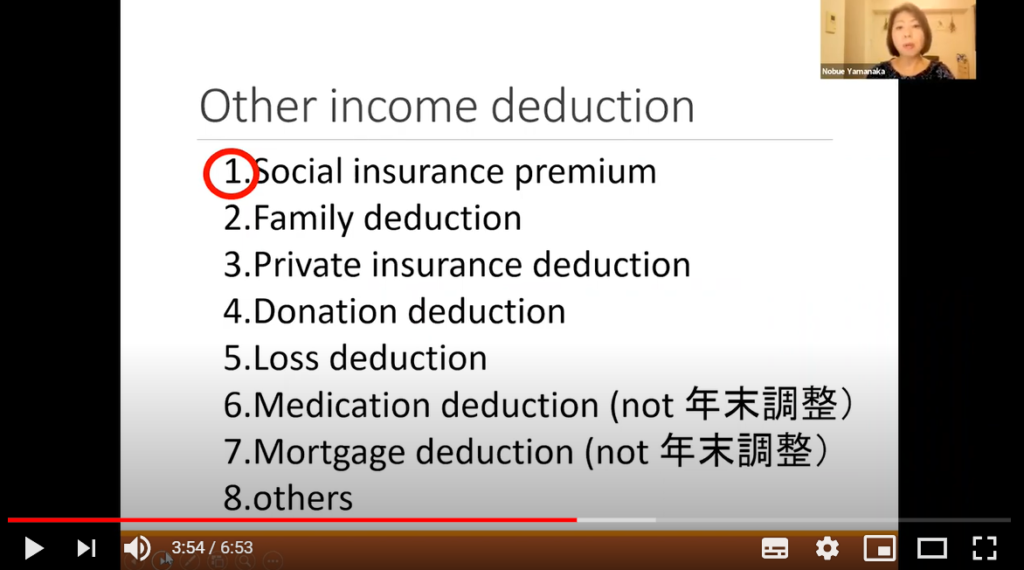

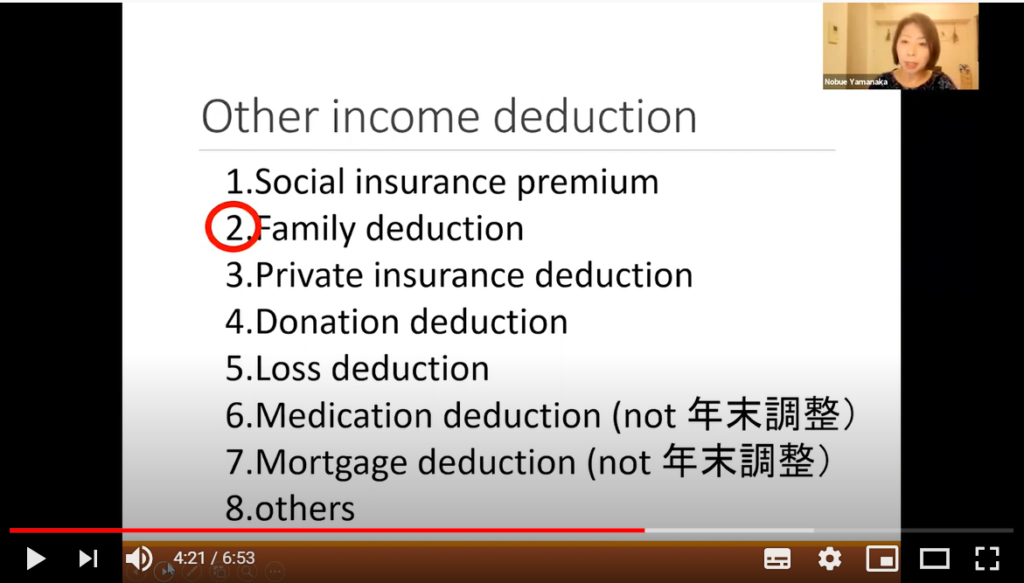

There are mainly eight items for other income deduction. You can deduct all the money you have paid for the premiums which is called social insurance premium deduction.

その他の所得控除には主に8種類があります。支払った社会保険料は全額控除となり、これを社会保険料控除と呼びます。

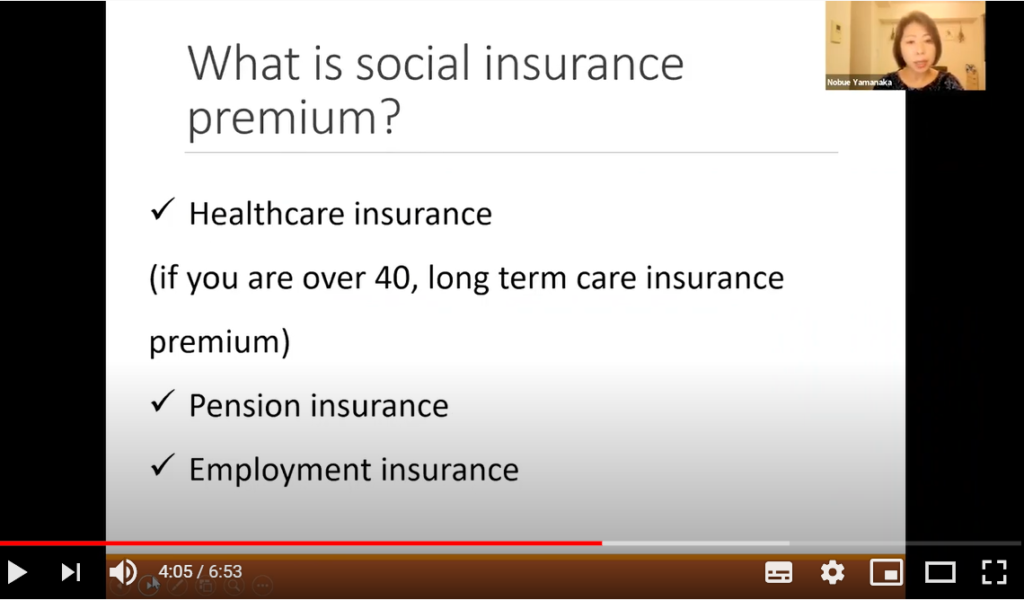

Social insurance premiums includes health care insurance, pension insurance, employment insurance. If you are over 40 long-term care insurance premiums is also deducted.

社会保険料には、健康保険、厚生年金保険、雇用保険、そして40歳以上なら介護保険料が含まれそれらすべてが控除の対象です。

If you have a dependent family you can use family deduction.

もし扶養している家族がいる場合も、控除の対象となる場合があります。

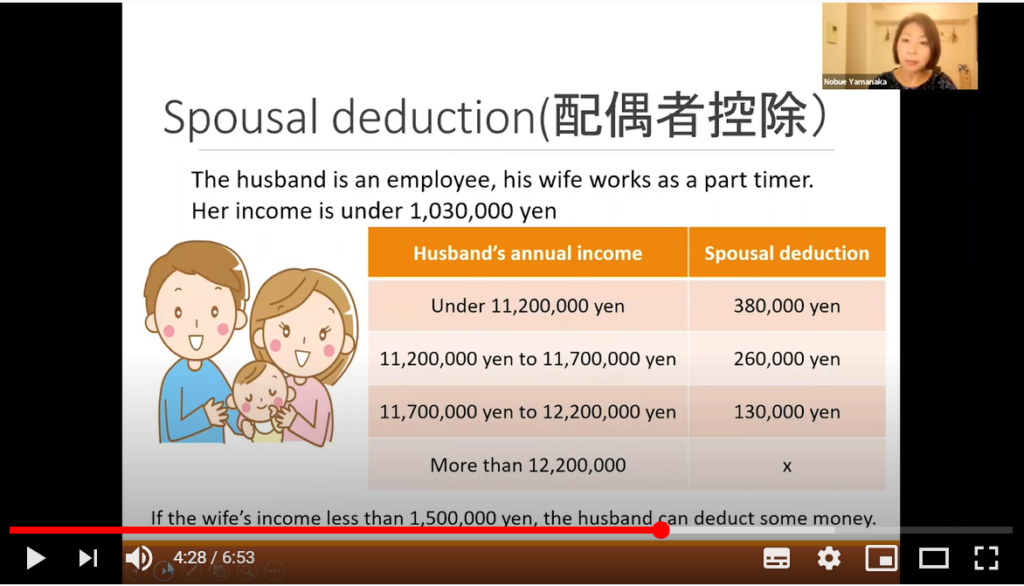

If you have a dependent wife or husband you can use spousal deduction which is called Haiguusha Koujo in Japanese. Let me give you an example, the husband is an employee his wife works as a past timer. Her income is under 1.03 million yen, In that case he can deduct the Spousal deduction. However the amount is different according to the annual income. In case his annual income is under 11 million two hundred thousand yen he can deduct 380,000 yen for the spousal deduction. Even if her income is over 1.03 million yen but less than 1.5 million yen he can still use some kind of spousal deduction.

もしあなたに扶養の妻、あるいは夫がいる場合、配偶者控除が使えます。例えば、会社員の夫、妻はパートタイマーで年収103万円未満の場合、夫は配偶者控除が使えます。配偶者控除は夫の年収により異なりますが、1120万円未満の場合の配偶者控除は38万円です。もし妻の年収が103万円以上150万円未満は、配偶者特別控除が使えます。

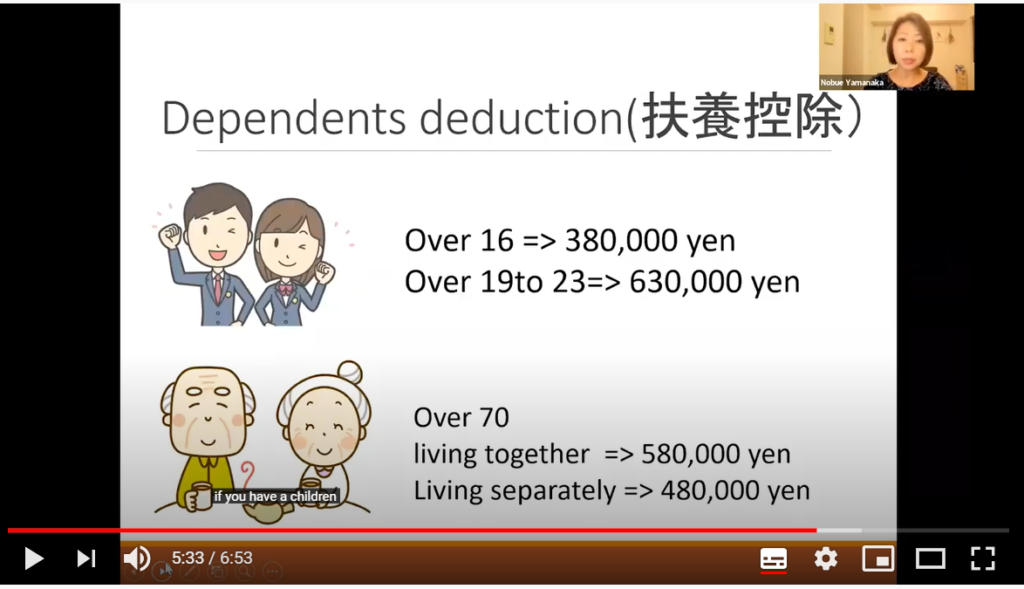

If you have a children over the age of 16 to 23 or if you have a parents over 70 you can use dependent deduction which is called Fuyou Koujo in Japanese. There is one thing I want you to be careful while you are making Nenmatsu Chousei paper. For example if you have a son and his age is 15, but he will be 16 in coming December please write his age 16 not 15 in order to get the dependent deduction. Because for the Nenmatsu Chousei the age is considered as of the end of the year.

もし16歳以上23歳未満のお子さんがいる場合、あるいは70歳以上のご両親がいるような場合、扶養控除が使えます。この場合、年末調整の用紙に記入する際、ひとつ注意して欲しいことがあります。例えばあなたに息子さんがいて現在15歳だとしましょう。でも今度の12月で16歳になるような場合は、15歳ではなく16歳と記入してください。なぜならば、年末調整は年度末の年齢で控除の計算をするからです。